On an annual basis RealtyTrac announces its state of the foreclosure market which serves to drive traffic to their site as well as give another data point to the state of the industry. Last week they made their announcement about the state of the foreclosure market, and unless you are in the short sale market, the data is what we all expected… NOT GOOD.

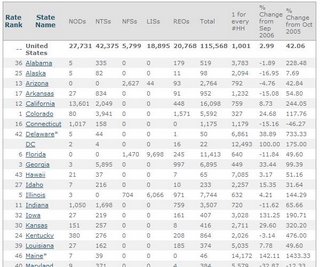

The RealtyTrac article explains that the number of properties in some stage of foreclosure has jumped over the past few months, with the year over year number for October at 43%. Forty-three percent more homes are in foreclosure this year than last with one in every 1000 households in jeopardy.

Now, other than lamenting, what are we to do with this information?

My personal recommendation is to brush up on the local short sale requirements for the lenders that serve your area and start incorporating this data into your value proposition. Many potential clients in your area desperately want to sell their home, but are in too upside down in the financing to divest the property. For these people and their peers, you can be a resource, and may be able to sell a few homes while you’re at it.

I do want to offer a word of caution when looking into servicing those that desperately need to sell in order to avoid foreclosure and bankruptcy. There are legal requirements in these deals that may limit your commission. These restrictions aside, you may consider taking more of a consultant approach and getting compensated for the time that you invest in helping a panicked client navigate the waters of a short sale.

No comments:

Post a Comment